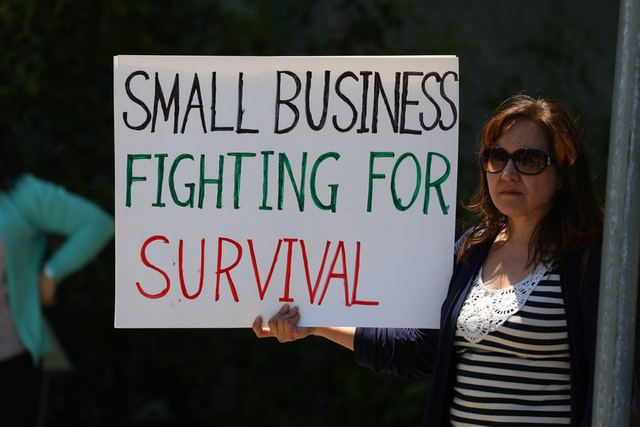

Proper financial planning reduces tax liability, making it less of a burden in achieving your short and long-term financial goals. Without it, you could face major tax implications. From maximizing your tax deductions to minimizing your tax liability, TPI can devise appropriate tax strategies for your current situation, as well as to help plan for …

Continue reading “What Happens to Your Tax Liability With Proper Financial Planning?”